Divide that number by 12 to get the first month’s interest charge: $37.50.Multiply the total amount of the loan by the interest rate: 450.

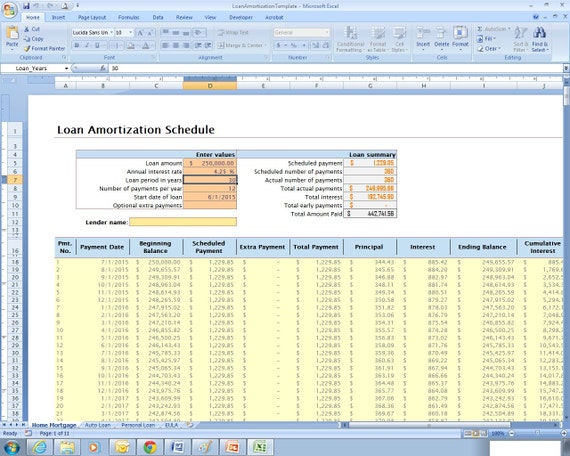

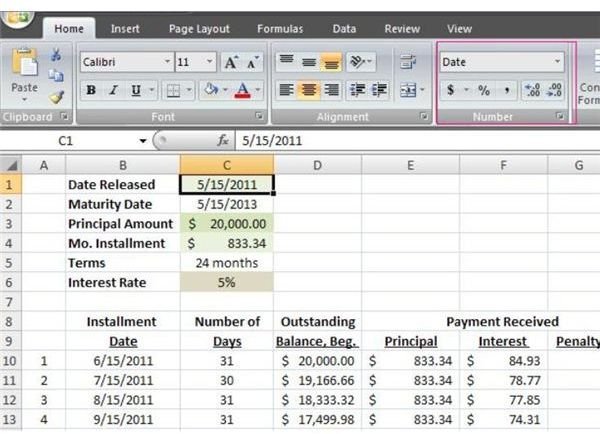

What would your amortization schedule look like? Here’s how to start your amortization chart, beginning with the first month: Your interest rate is 3%, and the loan term is 5 years. Let’s say you have a car loan of $15,000. To calculate basic amortization and create an amortization schedule, you need the following information: Make better decisions backed by data and insights Learn More How to Create an Amortization Schedule For now, let’s focus on amortization and amortization schedules as they apply to loan repayment. There is another financial situation in which you might come across amortization: bookkeeping and taxes for a small business or freelance gig, wherein the cost of an asset is spread out across the lifetime of the asset. Interest costs will be a higher portion of your monthly payment at the beginning of the loan because it is a percentage of your outstanding principal as more of your monthly payments are applied to principal, the interest costs shrink. At its most basic, amortization is paying off a loan over a fixed period of time (the loan term) by making fixed payments that are applied toward both loan principal (the original amount borrowed) and interest (the charge for taking out the loan, a percentage of the principal).įor example, if you are paying a mortgage, car loan, or student loan with a fixed interest rate, your monthly payment will remain the same over the lifetime of your loan, but the amount of each payment that goes toward principal and interest will change.

0 kommentar(er)

0 kommentar(er)